Accounting conservatism definition

Forex Compounding Calculator Become a Millionaire in 49 Days

May 4, 2021Wywiad z Januszem Palikotem: wierzyciele, nowi inwestorzy i prokuratura

May 5, 2021Accounting conservatism definition

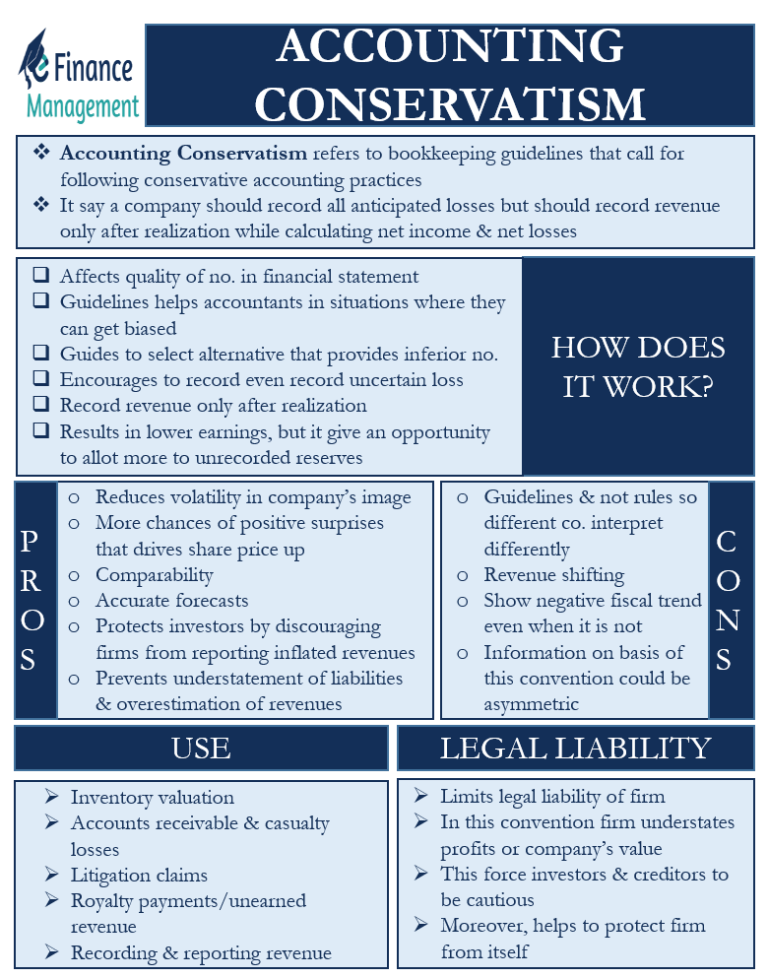

International Financial Reporting Standards (IFRS’s) and Generally Accepted Accounting Principles (GAAPs) are two broadly used accounting frameworks. Both incorporate the concept of prudence into many standards that fall within their scope. The prudence concept of accounting states that an entity must not overestimate its revenues, assets, and profits and must not underestimate its liabilities, losses, and expenses. Understating gains and overstating losses means that accounting conservatism will always report lower net income and lower financial future benefits.

Would you prefer to work with a financial professional remotely or in-person?

If an accountant has two solutions to choose from when facing an accounting challenge, the one that yields inferior numbers should be selected. One must remember that the concept of prudence is concerned with being cautious, which means realizing revenues only when they are likely to be realized and booking losses as soon as the loss becomes likely to occur. Another name used for prudence concept is the conservatism principle of accounting.

When Should You Use the Conservatism Approach in Accounting?

- Painting a bleaker picture of a company’s financials actually comes with several benefits.

- It’s rooted in the idea of playing it safe and being conservative in financial reporting to avoid overestimating the financial health or performance of a company.

- Auditors tend to be strong believers in conservatism as it applies to reserves, since it results in reduced levels of reported income.

Macdowell in his book “the accounting review.” This principle has been since then discussed and debated upon by numerous theorists. In particular, is considered wise to book an income only when it is realized. Alongside this, expenses should be booked as soon as a reasonable likelihood of their becoming payable is reached. Let’s take some examples to further elaborate on the concept of prudence. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Fundamental Analysis: Principles, Types, and How to Use It

It ensures that you prepare your financial statements as cautiously as possible. GAAP requires that accountants view estimates and uncertain business events with skepticism. Management will almost always lean toward the most optimal and opportunistic outcome in any situation. It’s the accountant’s job to look at the reality of the transaction and record it with a less than optimal outcome. The IRS has implemented several rules to mandate the recognition of taxable income in certain circumstances, in order to accelerate the recognition of taxable income.

The Conservatism Principle contributes to the reliability and credibility of financial statements by promoting a more conservative and cautious approach to accounting practices. This helps users of financial statements, such as investors and creditors, make informed decisions by being aware of potential risks and uncertainties that may affect a company’s financial position. While the principle promotes conservatism, it should be applied judiciously to avoid excessively understating the financial performance or position of a company. The focus of this concept is on transactions where there is a material amount of uncertainty involved, such as in the determination of estimates of bad debt, obsolete inventory, and sales returns. Similarly, conservatism can be applied to the recognition of gains and losses, where losses are generally recognized as soon as possible, while gains are deferred until it is quite certain that they will be realized.

In contrast, all the revenues and gains should not be recorded, and such revenues and gains should be recognized only when there is reasonable certainty of their actual receipt. Accounting conservatism is especially applicable to the recognition of revenue. There are numerous rules mandating that the recognition of revenue be deferred until all performance conditions by the seller have been completed. Similarly, a business cannot recognize a gain (for example) from a lawsuit, despite being certain of winning it, until the verdict is announced and cash is received.

The prudence Principles of Accounting is applied by recording all revenues, costs, and expenses only when they are likely to be realized or result in a liability. The entries made in the Financial Statements should bear the date on which it is made. The prudence Principles of Accounting is one of the most widely used and accepted criteria for preparation and reporting of Financial Statements. According to this principle, a business fully exercises good degrees of caution while booking incomes and expenses.

Accounting conservatism is a set of bookkeeping guidelines that call for a high degree of verification before a company can make a legal claim to any profit. To illustrate, assume that a company has inventory with a cost of $15,000. As a result, the goods in inventory can be sold for $14,000, but only if the company spends an additional $2,000 to package and ship franked dividend definition the goods. Remember when there is a event with an uncertain outcome, you want to recognize revenues when they are actually earned and recognize expenses when they are reasonably probable. As one of the principles included in the GAAP, conservatism is widely used in accounting. However, there are both benefits and drawbacks to consider with this technique.

It gives clear guidance in documenting cases of uncertainty and estimates. Say you’re trying to decide what your client’s allowance for bad debts should be. Still, if people use your client’s financial statements to make decisions, they’ll make decisions thinking your client’s net income is lower. XYZ Ltd. may win, or it may not win the amount it is expecting by winning the settlement. Since a sizable winning settlement amount may lead to complexities in financial statements and mislead users, this gain is not recorded in the books. Again taking the same example, if ABC Ltd. expects to lose the suit, it must record the losses in the footnotes of the financial statements.