Depreciation Tax Shield Formula + Calculator

Depreciation: Definition and Types, With Calculation Examples

June 3, 2021Тотальный тест «Доступная среда» 2 10 декабря 2022

June 4, 2021Depreciation Tax Shield Formula + Calculator

A depreciation tax shield is a tax reduction technique under which depreciation expense is subtracted from taxable income. The amount by which depreciation shields the taxpayer from income taxes is the applicable tax rate, multiplied by the amount of depreciation. This tax shield can cause a substantial reduction in the amount of taxable income, so many organizations prefer to use accelerated depreciation to accelerate its effect. Accelerated deprecation charges the bulk of an asset’s cost to expense during the first half of its useful life.

Tax Shield Formula

It can also depend on the type of taxable expenses being used as a tax shield. The good news is that calculating a tax shield can be fairly straightforward to do as long as you have the right information. You will need to know your individual tax rate as well how are dividends taxed how are they reported as the amount of all your tax-deductible expenses. In addition, these specialists can help you properly plan your taxes and advise on the topic of investing in depreciable assets as a tax minimization strategy and explain any possible risks and downsides.

Is Tax Shield the Same As Tax Savings?

The use of a depreciation tax shield is most applicable in asset-intensive industries, where there are large amounts of fixed assets that can be depreciated. Conversely, a services business may have few (if any) fixed assets, and so will not have a material amount of depreciation to employ as a tax shield. It should be noted that regardless of what depreciation method is used the total expense will be the same over the life of the asset.

A Beginner’s Guide to Effective WhatsApp Marketing in 2024

As you can see above, taxes are $20 without Depreciation vs. $16 with a Depreciation deduction, for a total cash savings of $4. Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business. Tax evasion occurs when people intentionally fail to report their revenue or income to the proper taxing authority, such as the Internal Revenue Service (IRS).

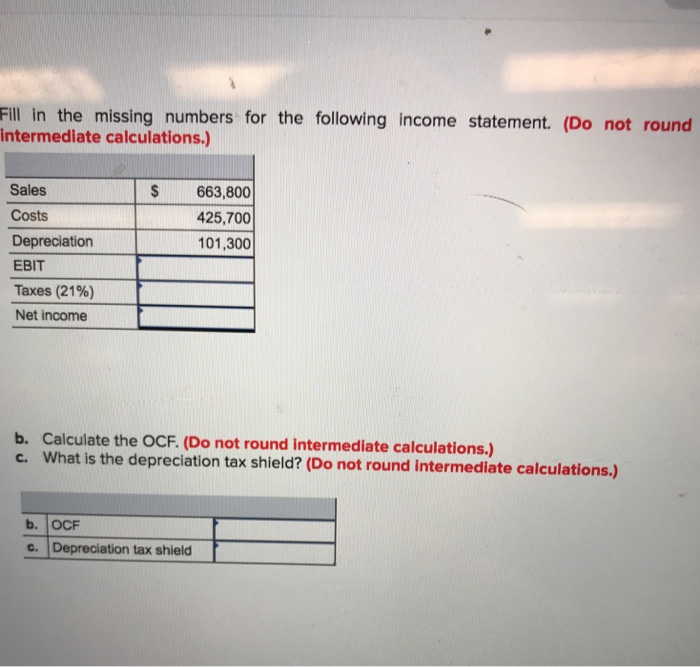

Suppose we are looking at a company under two different scenarios, where the only difference is the depreciation expense. The real cash outflow stemming from capital expenditures has already occurred, however in U.S. GAAP accounting, the expense is recorded and spread across multiple periods. Based on the information, do the calculation of the tax shield enjoyed by the company. With the two methods clarified, let’s look at the Cash Flow impact of each approach. Below is a break down of subject weightings in the FMVA® financial analyst program.

Tax Shields for Medical Expenses

- A depreciation tax shield is not about how much money you make, but rather how much money you get to keep.

- As you can see above, taxes are $20 without Depreciation vs. $16 with a Depreciation deduction, for a total cash savings of $4.

- The term “Tax Shield” refers to the deduction allowed on the taxable income that eventually results in the reduction of taxes owed to the government.

- But, first, do the calculation of Tax Shield enjoyed by the company.

- Interest tax shield refers to the reduction in taxable income which results from allowability of interest expense as a deduction from taxable income.

A tax shield in capital budgeting is a way for corporations to strategically plan their optimal capital structure and decide which investments to follow. This, in turn, makes debt funding much cheaper since interest expenses on debt are tax-deductible. The interest tax shield has to do with the tax savings you can receive from deducting various interest expenses on debt. The payment of the interest expense is going to ultimately lower the taxable income and the total amount of taxes that are actually due. Taxes are a big part of expense optimization and cost-cutting strategies. Although it is not an actual expense that you are writing off, it is lowering the income you have to pay taxes on, and, ultimately, you will have less expenses in the end.

Since depreciation expense is tax-deductible, companies generally prefer to maximize depreciation expenses as quickly as they can on their tax filings. Corporations can use a variety of different depreciation methods such as double declining balance and sum-of-years-digits to lower taxes in the early years. Interest tax shield refers to the reduction in taxable income which results from allowability of interest expense as a deduction from taxable income. The most significant advantage of debt over equity is that debt capital carries significant tax advantages as compared to equity capital. A tax shield represents a reduction in income taxes which occurs when tax laws allow an expense such as depreciation or interest as a deduction from taxable income.

Thus, the benefit comes from the time value of money and pushing tax expenses out as far as possible. Since depreciation is a non-cash expense and tax is a cash expense there is a real-time value of money saving. The impact of adding/removing a tax shield is significant enough that companies will take it into account when considering their optimal capital structure, which is their mix of debt and equity funding. Since the interest expense on debt is tax-deductible (while dividend payments on equity shares are not) it makes debt funding that much cheaper. A tax shield is a way that you can reduce the total amount of taxes owed on your federal tax return. It’s an allowable deduction that you can take from your taxable income.

The factor of (1-t) reduces the debt component which results in a lower WACC which in turn results in a higher present value of net cash flows. A 25 % depreciation for plant and machinery is available on accelerated depreciation basis as Income tax exemption. Assume that the corporate tax is paid one year in arrear of the periods to which it relates, and the first year’s depreciation allowance would be claimed against the profits of year 1.

As for the taxes owed, we’ll multiply EBT by our 20% tax rate assumption, and net income is equal to EBT subtracted by the tax. In the final step, the depreciation expense — typically an estimated amount based on historical spending (i.e. a percentage of Capex) and management guidance — is multiplied by the tax rate. In this case, the tax shield would amount to $25,000, meaning the business would save $25,000 in taxes due to the deductions or credits it has utilized.